Earlier this year, the Trump administration imposed a 10% tariff on all countries to improve domestic manufacturing capacity and an additional reciprocal tariff on countries with high trade deficits with the U.S. In response, textile imports faced higher tariffs: 35% on Bangladesh, 20% on Vietnam, 34% on China, 49% on Cambodia, 29% on Pakistan, and 26% on India. The tariff on Bangladesh was met with a positive rise in share prices of Indian textile firms, notably, Arvind Limited and Gokaldas Exports, in intraday trading up to 8.2%, signalling market optimism about India’s potential gain.

The United States textile and apparel manufacturing sector has experienced a significant decline in its production value over the past decade. Despite efforts to revive the domestic textile sector through the ‘Made in the USA’ initiative, the size and scale of apparel manufacturing in the U.S., as compared to developing countries, is significantly lower, with more than 76% of apparel mills employing fewer than 10 employees and operating as micro factories. Fashion brands and retailers also refuse to shift from a designing, supply chain management, and marketing model to manufacturing. This suggests that, given the current economies of scale, substituting domestic manufacturing for imports is not a viable option.

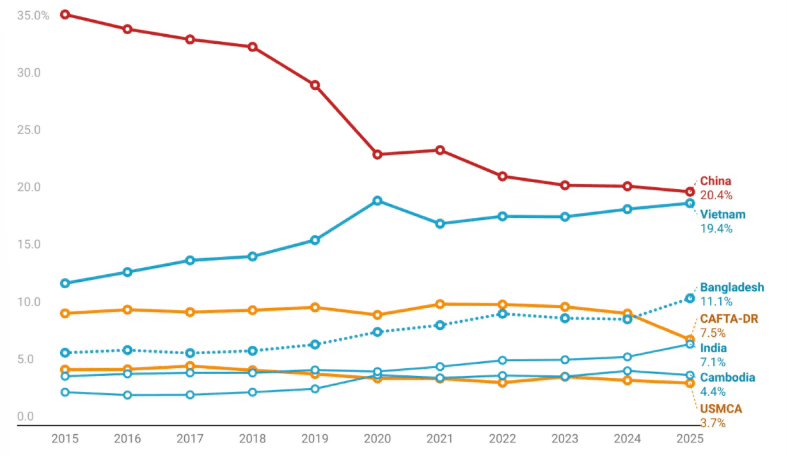

Figure 1: Sources of US Apparel Imports (by value)

Source: Dr.Sheng Lu, Office of Textiles and Apparel(OTEXA), U.S. Department of Commerce

Approximately 75.6% of the U.S.’s apparel imports come from Asia. Despite a steep decline from 35% to 20%, China continues to be the largest exporter, followed by Vietnam and Bangladesh. India’s share of imports has grown modestly from 4% to 7% despite being the second-largest textile manufacturer in the world.

Against this context, high reciprocal tariffs on the top three textile exporters to the US open a window of opportunity for textile manufacturers in India. India has a long-standing textile tradition, with a wide trade network. In recent trends, Textile and apparel exports account for a 12% share of total Indian exports. Of the total $36 billion in textile exports for 2023-24, exports to the U.S. amounted to $10 billion. Textile exports are also expected to grow at a 10% CAGR by 2026. The industry contributes to 2.3% of the GDP, employing 45 million people directly and 100 million people through allied industries. Make in India and PLI schemes have incentivised the sector to enhance infrastructure, access to credit, marketing, and sustainability.

India’s potential to emerge as a competitive alternative to leading apparel exporters raises important questions about its capacity and readiness. India has huge resource capabilities, with more than 90% of textile raw materials to produce apparel being sourced domestically, as compared to Vietnam and Bangladesh, with 64% and 33% materials sourced from outside the country. Being one of the largest textile fibre producers, 60% of US textile imports from India contain cotton fibre, including 13% organic cotton. 45% of India’s apparel exports to the US were under the luxury component in 2024, exceeding that of Bangladesh and Vietnam. Flexibility and agility in sourcing with a low minimum order quantity (MOQ) and diversity in product categories relative to other Asian countries are also advantages. The huge domestic consumer market directs at significant untapped export potential of the country.

Scalability is a critical bottleneck, with 80% of the industry composed of MSMEs. Although the quality of products is regarded as high-value and high-quality, they are not cost-effective owing to the limited production capabilities of MSMEs. Kumar Duraiswamy, Joint Secretary of the Tirupur Exporters’ Association, opines that most MSMEs in Tirupur run on tight margins, which could potentially weaken the entire value chain, affecting exports. Since importers demand large-scale production units for greater reliability, there is a need to improve the scalability of domestic industries.

India primarily pioneers in natural fibre exports, which constitute a small part of global consumption. 72% of global textile fibre consumption is attributed to man-made fibres. To cater to this growing demand for technical and synthetic fibres, the government has encouraged the production of man-made fibres and expects a 75% increase in its exports from India by 2030. Mr. Kumar views an opportunity in this segment, owing to higher tariffs on Jordan, which exports sportswear and man-made fibre products, expanding MMF production in India will aid in meeting the demand in this component.

Figure 2: Unit Price of US Apparel Imports: 2025 vs 2024

created by: Dr.Sheng Lu | data: OTEXA, U.S. Department of Commerce

The graph shows the post-tariff average cost per unit of apparel imports by the U.S.; while prices of products from Vietnam and Bangladesh rose by 3.6% and 2.6% respectively, Indian imports became 4.7% cheaper. This might be a deliberate strategy to boost export competitiveness. However, this increasing trend in prices risks shrinking the consumption market in the US. In March 2025, the U.S. Consumer Confidence Index dipped considerably, which could potentially hinder US apparel imports in the next few months.

This new tariff regime provides an impetus to the China Plus One Strategy, improving the competitiveness of India’s textile and apparel products. Despite the garment sector shifting to cheap labour-intensive countries like Bangladesh and Vietnam, China’s growth in the sector remained stable. Notwithstanding a drop in apparel exports, textile exports rose significantly owing to the dependency of other countries in the region, including India, on China’s textile raw materials. However, considering geopolitical tensions and tariffs on other regional sourcing hubs, India is in a favourable position to act as an alternative to China.

To capitalise on this opportunity, India needs to upscale its textile production activities through capacity building of industries like the initiative PM Mega Integrated Textile Region and Apparel Parks (PM MITRA), and substantial investment in research and development. A conducive environment must be enabled to encourage foreign direct investments. Adequate skill development training must be undertaken through vocational training institutes to enhance the productivity of the sector. Diversification of trade is essential to mitigate market risks and reduce overdependence, for instance, the Free Trade Agreement with the UK for textile imports. Thus, equipping the sector with the infrastructure, capabilities, and policy support needed to boost export competitiveness and scale production is not only essential to navigate rising tariff pressures but also to seize this moment as a strategic opportunity for global positioning.

References:

Lu, D. S. (2025). The State of U.S. Textile and Apparel Manufacturing, Employment, and Trade. United States Fashion Industry Association. Retrieved from https://www.usfashionindustry.com/news/fashion-intel-analysis/the-state-of-u-s-textile-and-apparel-manufacturing-employment-and-trade

Paresh Parekh, T. S. (2025). US Reciprocal Tariffs Impact on Textile and Garment Sector- Boon or Bane? Times of India. Retrieved from https://timesofindia.indiatimes.com/business/india-business/opinion-us-reciprocal-tariffs-impact-on-textile-and-garment-sector-boon-or-bane/articleshow/119951137.cms

Agarwal, N. (2024). Indian Textile Sector Report 2025. In Wright. https://www.wrightresearch.in/encyclopedia/indian-textile-sector-report-2024/

Lu, S., & Giolli, G. (2024, December 1). New study: Exploring India as an apparel sourcing base for U.S. fashion companies. FASH455 Global Apparel & Textile Trade and Sourcing. https://shenglufashion.com/2024/12/01/new-study-exploring-india-as-an-apparel-sourcing-base-for-u-s-fashion-companies/

Dewan, N. (2025, April 14). Fabric of the industry frays: What Trump’s tariffs really mean for India’s textile sector. The Economic Times. https://economictimes.indiatimes.com/small-biz/sme-sector/fabric-of-the-industry-frays what-trumps-tariffs-really-mean-for-indias-textile-sector/articleshow/120270915.cms

United States International Trade Commission. (2024). Apparel: export competitiveness of certain foreign suppliers to the United States. https://www.usitc.gov/publications/332/pub5543.pdf